ISO 14053:2021 pdf download – Environmental management — Material flow cost accounting — Guidance for phased implementation in organizations.

3.3 material substance that enters and/or leaves a process Note 1 to entry: Materials can be divided into two categories: — — materials that are intended to become part of products, e.g. raw materials, auxiliary materials, intermediate products; materials that do not become part of products, e.g. cleaning solvents and chemical catalysts, which often are referred to as operating materials. Note 2 to entry: Some types of materials can be classified into either category, depending on their use. Water is one such material. In some cases, water can become part of a product (e.g. bottled water), while in other cases it can be used as an operating material (e.g. water used in an equipment washing process). Note 3 to entry: Energy carriers like fuels or steam can be identified as materials, at the discretion of the organization. [SOURCE: ISO 14051:2011, 3.10, modified — “quantity centre” changed to “process”.] 3.4 material flow cost accounting summary sheet MFCA summary sheet spreadsheet that reflects the MFCA (3.6) information for a production process that is treated as a single process 3.5 material cost cost for a substance that enters and/or leaves a process Note 1 to entry: Material cost can be calculated in various ways, e.g. standard cost, average cost, and purchase cost. The choice between cost calculation methods is at the discretion of the organization. [SOURCE: ISO 14051:2011, 3.12, modified — “quantity centre” changed to “process”.] 3.6 material flow cost accounting MFCA tool for quantifying the flows and stocks of materials (3.3) in processes or production lines in both physical and monetary units [SOURCE: ISO 14051:2011, 3.15] 3.7 material loss all material outputs generated in a process, except for intended products Note 1 to entry: Material losses include air emissions, wastewater and solid waste, even if these material outputs can be reworked, recycled or reused internally, or have market value. Note 2 to entry: By-products can be considered as either material losses or products, at the discretion of the organization. [SOURCE: ISO 14051:2011, 3.16, modified — “quantity centre” changed to “process”.] 3.8 system cost cost incurred in the course of in-house handling of the material (3.3) flows, except for material cost (3.5), energy cost (3.1) and waste management cost (3.9) EXAMPLE Cost of labour; cost of depreciation and maintenance; cost of transport. [SOURCE: ISO 14051:2011, 3.21]

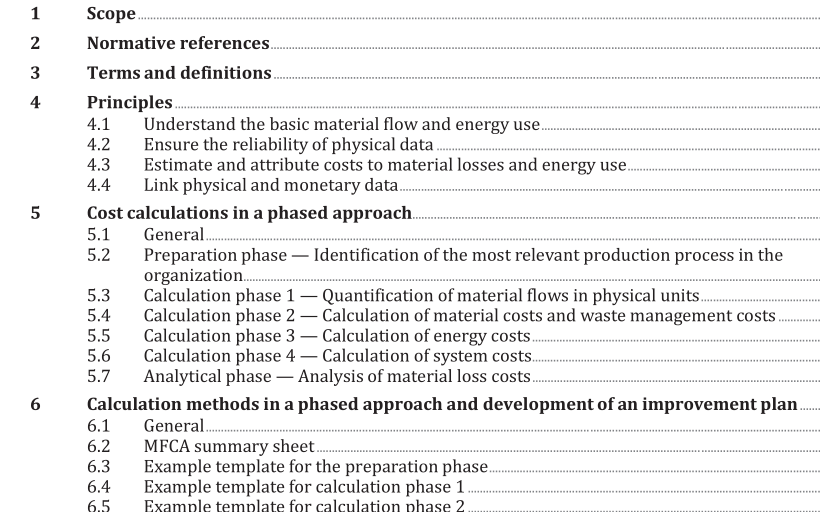

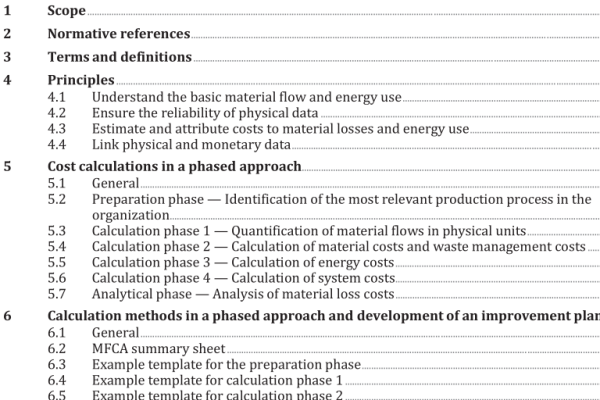

5.3 Calculation phase 1 — Quantification of material flows in physical units The amounts of material inputs and outputs should be quantified in physical units such as mass, length, number of pieces or volume, depending on the type of materials. Outputs are divided into products and material losses. 5.4 Calculation phase 2 — Calculation of material costs and waste management costs Cost calculations should be started with material costs. This includes costs related to the materials used in the most relevant production process which may include raw materials, auxiliary materials, operating materials and intermediate products. The costs of all material inputs are assigned to products and material losses according to the physical quantity. In addition, waste management costs are calculated. 5.5 Calculation phase 3 — Calculation of energy costs The calculation of energy costs is at the discretion of the organization. When it is determined to be necessary, energy costs should be calculated and allocated to products and material losses according to the physical data quantified in calculation phase 1. 5.6 Calculation phase 4 — Calculation of system costs The calculation of system costs is at the discretion of the organization. When it is determined to be necessary, system costs should be calculated and allocated to products and material losses according to the physical data quantified in calculation phase 1.

ISO 14053:2021 pdf download – Environmental management — Material flow cost accounting — Guidance for phased implementation in organizations